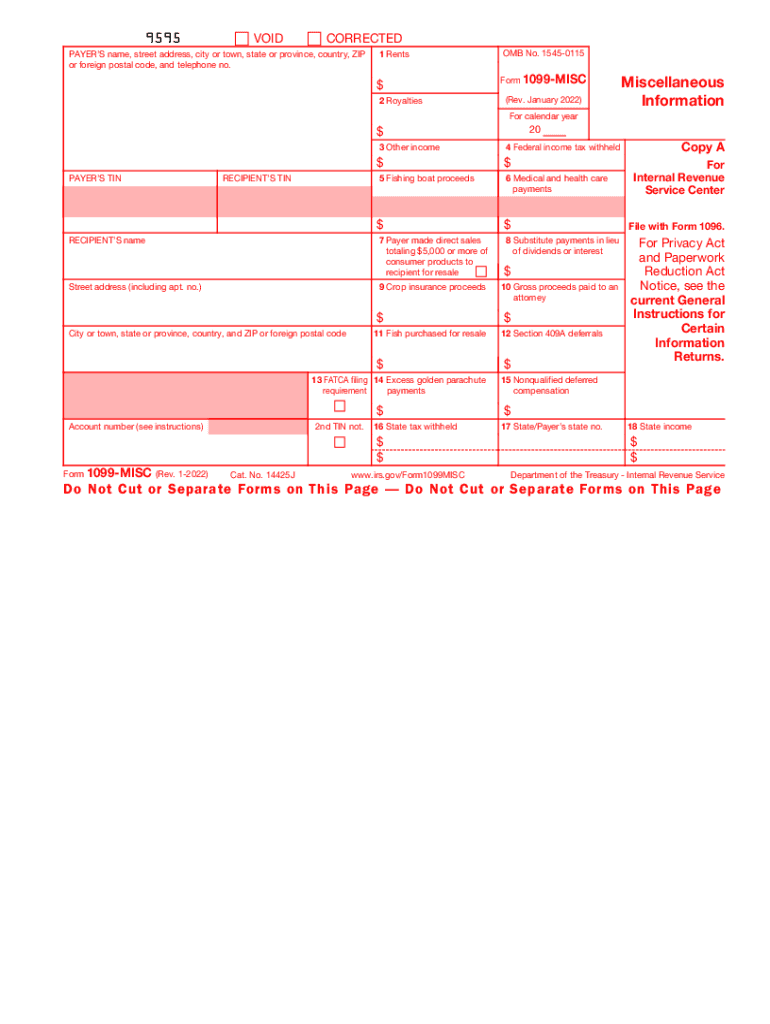

How To Get Onlyfans 1099 Form Online - Web Jun 16 2023 nbsp 0183 32 Obtain Form 1099 MISC from OnlyFans OnlyFans may provide you with a Form 1099 MISC if you have earned income above a certain threshold typically 600 during the tax year This form will report your earnings from OnlyFans and is essential for accurately reporting your income on your tax return

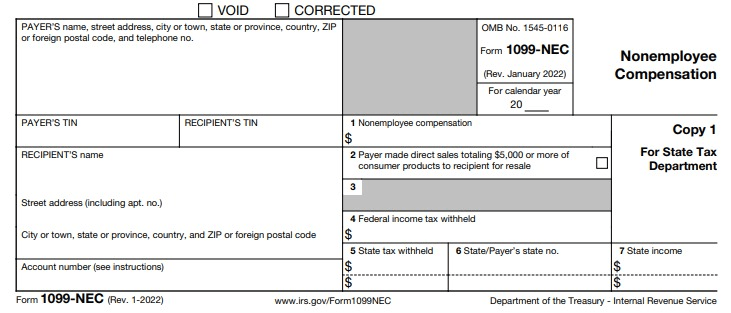

Web Aug 30 2023 nbsp 0183 32 At the end of the year creators will receive a form 1099 NEC from OnlyFans listing your total earnings for the year This is your gross business income and you can refer to it when it s time to file your self employment taxes Step 1 Download your 1099 NEC OnlyFans provides its 1099s digitally on the banking screen of the app

How To Get Onlyfans 1099 Form Online

How To Get Onlyfans 1099 Form Online

Web Aug 29, 2022 · 1099-K forms from payment providers like PayPal if you accept payment for content outside of OnlyFans—sent to you, or downloaded from your payment account A record of expenses that incurred and can be deducted from your income to lower taxes.

Web May 19 2023 nbsp 0183 32 If you re wondering how to get your 1099 from OnlyFans the first thing you should do is check your mailbox OnlyFans will send the form via mail to the address you provided in your account If you haven t received it yet don t worry OnlyFans sends these forms out through January so it might just take some time to arrive

OnlyFans Taxes How To Pay And Ways To Save Keeper

Web Jan 8 2022 nbsp 0183 32 You will need to fill out the OnlyFans W9 form before you can withdraw earnings You will receive an Onlyfans 1099 form in January via mail and a digital version on the platform You will file a Schedule C and a Schedule SE with your 1040 income tax return You can write off business related expenses to reduce your taxable income

How To File OnlyFans Taxes W 9 And 1099 Forms Explained

Web May 11 2023 nbsp 0183 32 Log in to your OnlyFans account and download your 1099 NEC form Once you provide your address information OnlyFans will send you the 1099 NEC form detailing your earnings from the platform for the previous

1099 NEC Form 2022

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

Onlyfans Taxes Explained Everything You Need To File Onlyfans

Web Feb 20 2023 nbsp 0183 32 One way to demonstrate your OnlyFans income is through a 1099 MISC form The 1099 MISC is a tax form used to report miscellaneous income including income from self employment sources such as OnlyFans OnlyFans will send you this form if you earned more than 600 from the platform in a calendar year

How To Properly File 1099 Form For Onlyfans FreeCashFlow io 2023

Web May 18 2023 nbsp 0183 32 According to Doola you need to declare your earnings made on OnlyFans as other income on your 1040 form However if you re treating your OnlyFans account as a legitimate business then you can report it on a Schedule C form This guide will cover the basic steps you need to take to put OnlyFans on taxes properly

Web Nov 16, 2021 · According to the law in the United States, if you have an account on OnlyFans that you deleted, the platform is required to give you Form 1099 that you need when filing your return. So if you haven’t received it yet, you can contact OnlyFans for them to provide it to you.

OnlyFans Taxes In 2022 A Comprehensive Guide 1099 Cafe

Web The type of 1099 form you ll receive if you make more than 400 a year is the 1099 NEC form for non employee compensation You should also receive a copy by mail or you can download it from your OnlyFans user account dashboard Your 1099 forms should arrive via mail in January

Instructions 2021 Turbo Tax

OnlyFans Hack How To Get OnlyFans Premium For Free OnlyFans Free Sub Spotify Premium

How To Get Onlyfans 1099 Form Online

Web May 18 2023 nbsp 0183 32 According to Doola you need to declare your earnings made on OnlyFans as other income on your 1040 form However if you re treating your OnlyFans account as a legitimate business then you can report it on a Schedule C form This guide will cover the basic steps you need to take to put OnlyFans on taxes properly

Web Aug 30 2023 nbsp 0183 32 At the end of the year creators will receive a form 1099 NEC from OnlyFans listing your total earnings for the year This is your gross business income and you can refer to it when it s time to file your self employment taxes Step 1 Download your 1099 NEC OnlyFans provides its 1099s digitally on the banking screen of the app

1099 Form Independent Contractor Pdf 1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Social Security 1099 Form Pdf Form Resume Examples qb1VND61R2

11 Common Misconceptions About Irs Form 11 Form Information Free Printable 1099 Misc Forms

2022 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

How To File Form 1099 Misc Without Social Security Number Form Resume Examples BpV577M91Z