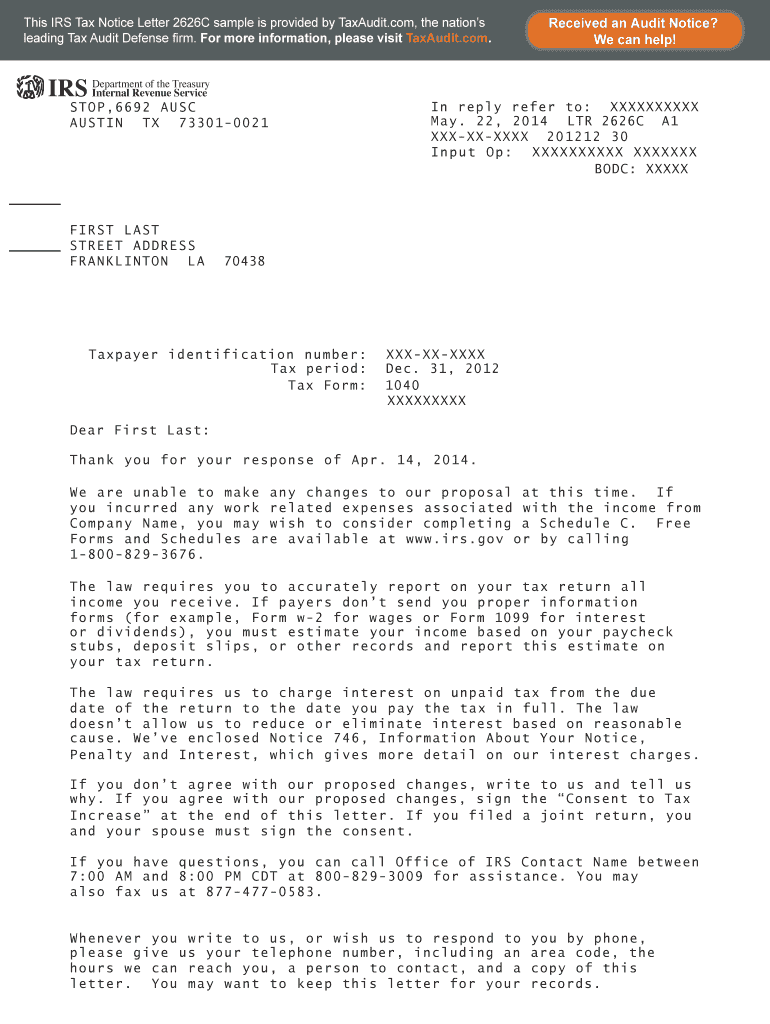

Ms Word Irs Letter Of Explanation Template - The tax code provides that if you don t object to an automated adjustment notice within 60 days it becomes final There is no preprinted IRS form to contest automated tax notices Send a typewritten letter to the IRS office that sent the notice Use the format in the sample letter below

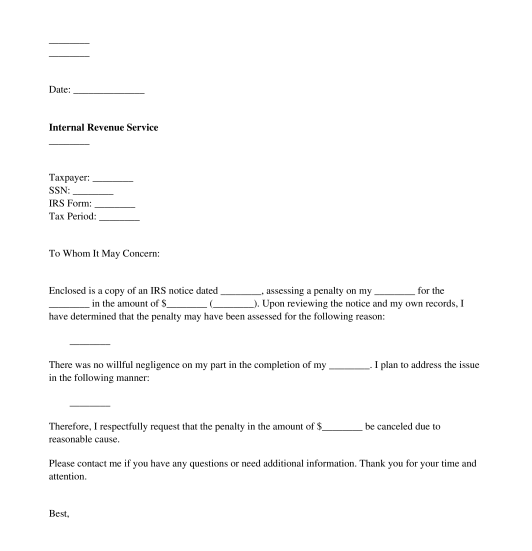

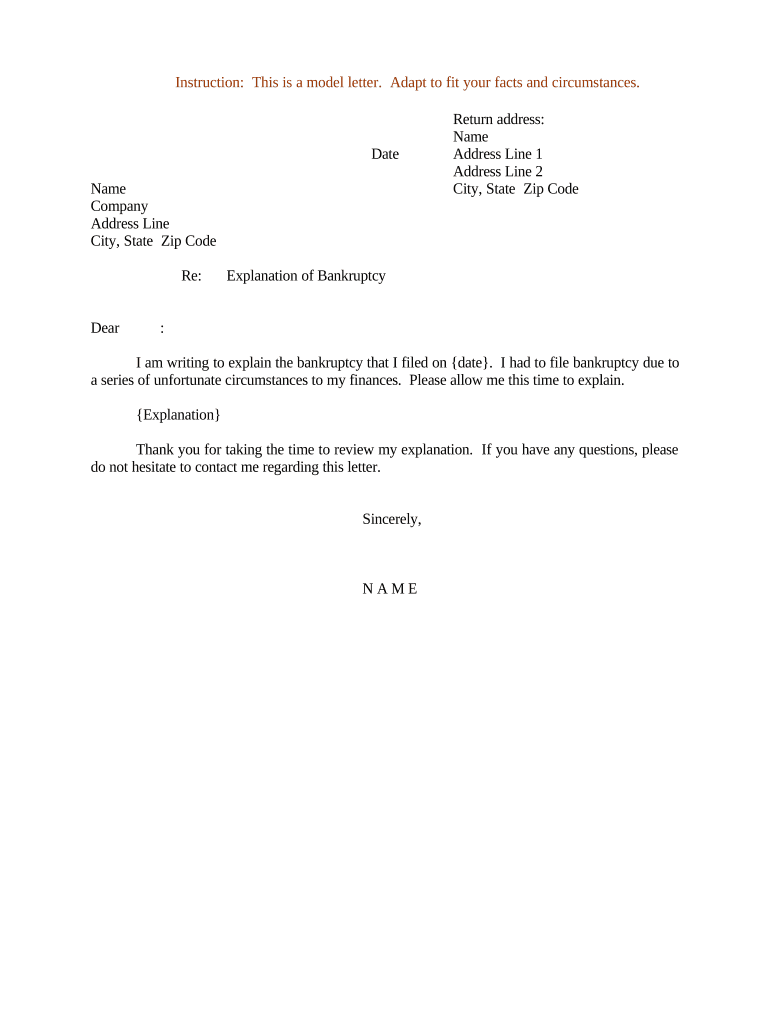

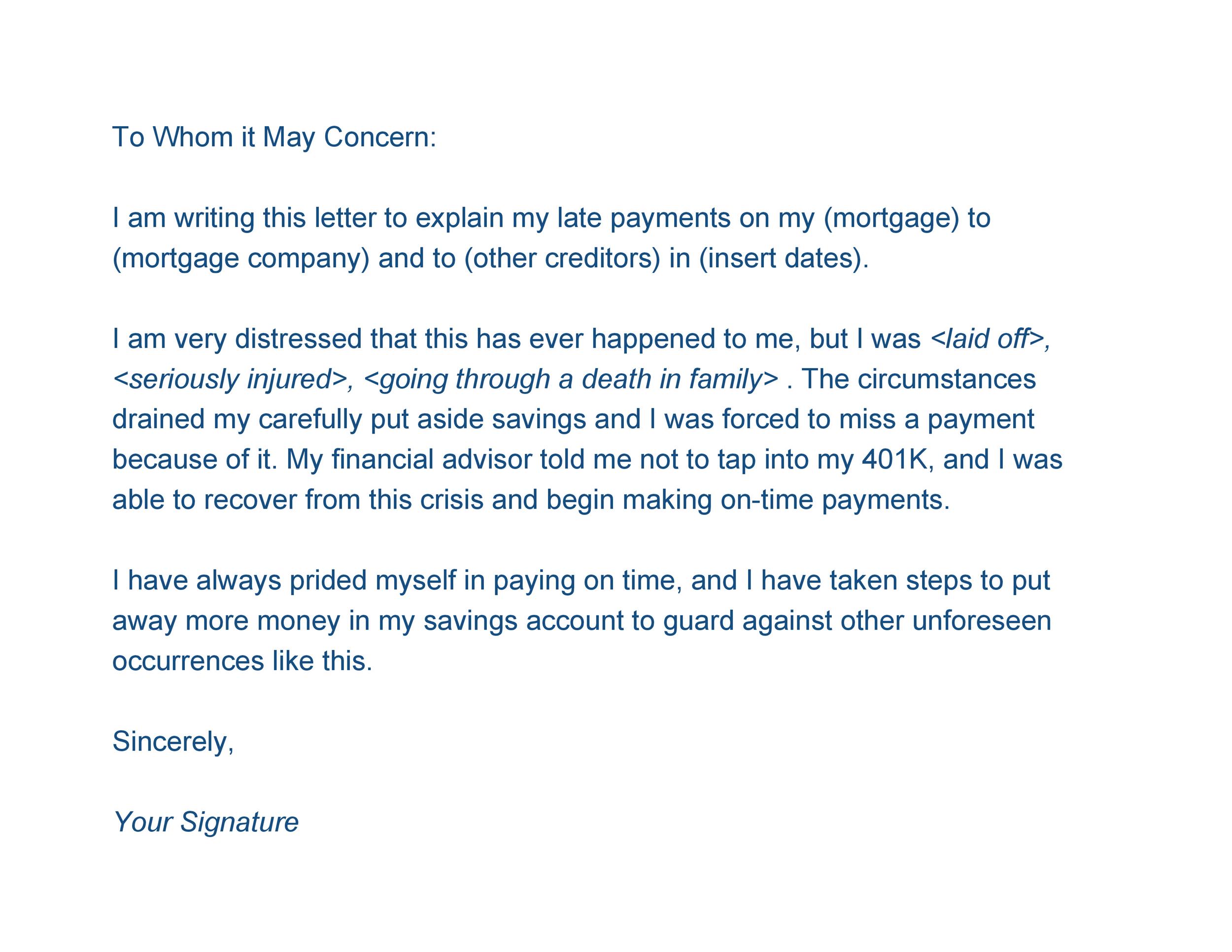

How To Write An Explanation Letter To The IRS Depending on is requirement there are different samples for thou to look at and write a letter of explanation to the IRS It is different for asking for abatement of the penalty of one year and abatement concerning the penalty of show than one previous year as shown below

Ms Word Irs Letter Of Explanation Template

Ms Word Irs Letter Of Explanation Template

Sign in. How to Write a Letter of Explanation to the IRS.docx - Google Drive. Sign in

Written Explanation Sample Letter to the IRS Most IRS letters have two options agree with the changes the IRS is making or send a written explanation of why the IRS is wrong and you are right This post explains what you should consider when responding to the IRS and gives some examples you can use

COMPLETE Guide To Writing Explanation Letters To The IRS 2023

At a Glance An explained letter also known as ampere letter of explanation is used to clarify discrepancies or provide ampere predictive explanation for unusual activity int records such as financial or tax recorded It the important required creating a positive impression when applying forward benefits instead addressing mistakes Individuals may

How Write Letter Explanation The Irs From Success Tax With Irs Response

Advance Child Tax Credit Letters Get details on letters about the 2021 advance Child Tax Credit payments Letters 6416 and 6416 A Letter 6417 Letter 6419 Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue

Pin On Templates

Irs Letterhead Fill Online Printable Fillable Blank PdfFiller

IRS Automated Adjustment Dispute Letter Template

Tax records Allow at least 30 days for a response from the IRS If you have questions call the telephone number in the letter Have a copy of your tax return and the correspondence available when you call Check Understanding Your IRS Notice or Letter on IRS gov for samples of the letters

Sample Letter Explaining Late Payments Best Of 48 Letters Explanation

How To Write a Letter of Explanation to the IRS From Success Tax Relief May 1 2015 0 likes 68 289 views Download Now Download to read offline Economy Finance How to write a letter of explanation to the IRS regarding an inquiry sent to you from the experts at Success Tax Relief

There is no need to submit a letter of explanation with your tax return. They won't read it anyways. You have three options: Submit your tax return with the information from the current SSA-1099. If the SSA changes it, then you can amend your tax return. Submit your tax return with the way that you think it should be.

How To Write A Letter Of Explanation To The IRS Docx

Let the IRS know of a disputed notice If a taxpayer doesn t agree with the IRS they should mail a letter explaining why they dispute the notice They should send it to the address on the contact stub included with the notice The taxpayer should include information and documents for the IRS to review when considering the dispute

Irs Name Change Letter Sample Incnow Order Form After You Have

Irs Form 843 Printable

Ms Word Irs Letter Of Explanation Template

How To Write a Letter of Explanation to the IRS From Success Tax Relief May 1 2015 0 likes 68 289 views Download Now Download to read offline Economy Finance How to write a letter of explanation to the IRS regarding an inquiry sent to you from the experts at Success Tax Relief

How To Write An Explanation Letter To The IRS Depending on is requirement there are different samples for thou to look at and write a letter of explanation to the IRS It is different for asking for abatement of the penalty of one year and abatement concerning the penalty of show than one previous year as shown below

IRS Audit Letter 4364C Sample 1

Written Explanation Sample Letter To Irs Slide Share

Letter Of Explanation Doc Template PdfFiller

Irs Letter Template Shatterlion info

48 Letters Of Explanation Templates Mortgage Derogatory Credit